Taking on the role of a chief financial officer means leading the financial helm of the company—and this task, as you’re well aware, is no easy feat. Failure to keep the ship under control can result in financial losses or high running debts that the company can’t easily overcome.

From ensuring legal and financial compliance to consolidating spreadsheets across various departments within the space, there’s no shortage of things you need to be on top of when ensuring cohesion and harmony in the financial well-being of the company.

One particular area where things can quickly become complex is multi-entity reconciliation. This task involves coordinating with various parties and subsidiaries, with some being external stakeholders and cross-border staff members. Ensuring that they’re all aligned is critical to ensure that the organisational operations flow as smoothly as possible.

While the complexity of this task will ultimately hinge on the company’s size and structure, this doesn’t take away the fact that multi-entity reconciliation is essential for keeping financial reports consistent and systems operating smoothly across different teams and even borders.

That being said, if you’re facing issues trying to reconcile these different entities, then you’re in the right place. This article will walk you through the importance of multi-entity reconciliation in the realm of finances, common problems faced by executives and teams in this space, and how you can reconcile these entities with your authority as a CFO.

Let’s jump right into it.

Why Multi-Entity Reconciliation Matters for CFOs

Multi-entity reconciliation is of vital importance for companies to uphold for several reasons.

It’s a process that businesses dealing with multiple departments and entities need to be on top of, as this ensures that the financial picture of your company is organised, aligned, and compliant with all relevant governing bodies.

But overall, the primary reason why this matters is that multi-entity systems hold natural complexity due to the various brains involved in the operation, often across different environments. When multiple teams operate on different systems and record different currencies, inconsistencies can arise.

These inconsistencies may not be immediately obvious, but they tend to surface when it matters. Think of periods like the month’s end, audit preparation season, or times wherein you have to consolidate all your finances for the periodic, big-picture report across various horizontals.

If these entities aren’t reconciled, your team will have to work overtime to fix, rework, or adjust the numbers to ensure they’re balanced and properly reported. And even then, success isn’t a guarantee.

At the CFO level, reconciliation activities aren’t something you specifically handle—you have multiple teams and a pointperson for that. It’s more of something you should lead, organise, and manage to ensure that the entire company’s financial statements and transactions are as consistently, promptly and accurately reported as possible.

Failure to properly reconcile numbers across different currency accounts can result in errors in your final accounting report. This figure inflation (or deflation) can give investors and interested stakeholders the wrong idea of your company’s current performance, which can make succeeding interactions and partnerships based on faulty figures and statistics.

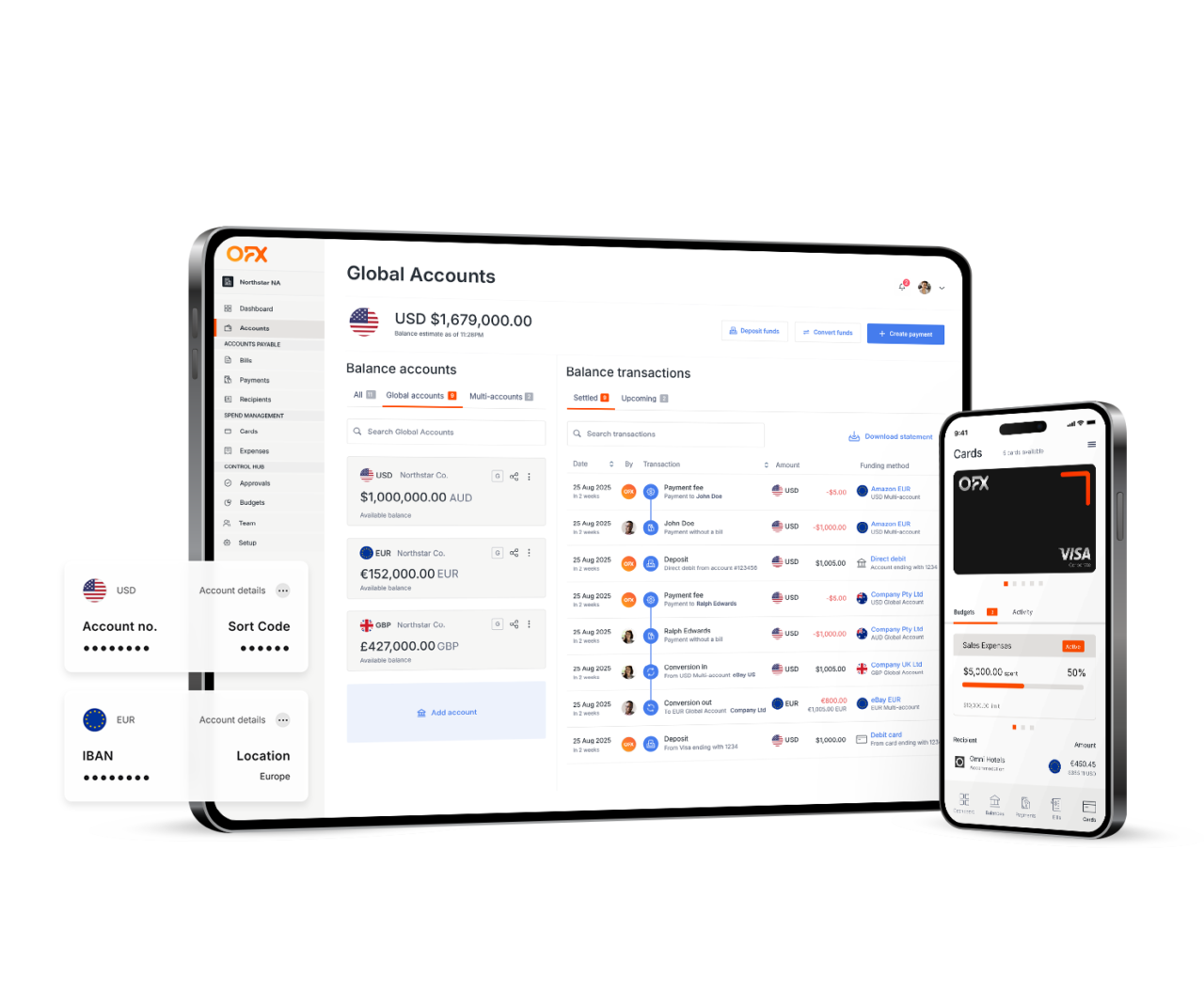

With software tools like OFX helping companies reconcile and centralise accounts across different offices, there’s truly no excuse when it comes to getting a clear view of your business’s financial performance.

When multi-entity reconciliation is handled well, all staff members of the company will have a clear view of the financials. This, in turn, can enable everyone to prepare and make more informed decisions for the upcoming quarter.

How CFOs Can Reconcile Multiple Entities

While the bulk of the legwork is performed by hired staff members, process-building falls squarely on your shoulders.

Your role as the CFO involves building a repeatable and scalable structure that can reconcile data across multiple entities—such as different offices—in a harmonious fashion and without unnecessary bottlenecks.

Read below to see some of the most effective ways CFOs can streamline and improve reconciliation across the organisation.

-

Standardise Reconciliation Policies Across All Working Systems

The first thing you should do is to set rules that all teams can easily follow, regardless of their main branch of operations. As the chief financial officer, you should make it easy for the team to reconcile various entities without having to translate processes from one office to another.

You can start by making a uniform SOP policy that applies across every system your teams use. This may mean opting for the same accounting software, internal SAAS tools, and so on.

If there are geographical or legal limitations to the tools available across regions, just ensure that there are clear reconciliation instructions in place for cross-team referencing, as well as easy-to-follow controls that are similar across regions. Tools like Scribe can help you build SOPs with ease.

A standardised policy creates a baseline for performance, making it easier to identify performance deviations across entities and where systems or processes need improvement. It also strengthens audit readiness—making it more defensible across the entire operations.

-

Establish Clear Ownership, Review, and Accountability

Another important aspect of being a CFO is to hold yourself accountable for the systems you put in place regarding your entity reconciliation processes.

If there are delays, bottlenecks, or issues in the current process, then you should seek to resolve these issues before the next reporting period.

Every organisation needs a sound structure to operate efficiently. If there’s ambiguity in the process, or a lack of ample documentation, this could cause team members to become uncertain about tasks—which can make operations heavy-handed and make discrepancies linger longer, making it even more difficult to fix later on.

To prevent this, it’s essential that you keep a close eye on the system and rules you’re defining as the finance head. Review your operations meticulously and set timelines, documentation processes, and escalation paths that make it easy for you to stay in the loop.

You should also be closely in touch with each financial department across various fronts to ensure that their tasks are clearly laid out and that they know what to do and who to contact for further assistance.

-

Centralise Financial Data

Another vital function every chief financial officer should perform is to centralise financial data across all internal channels as much as possible.

While each team can have their own internal protocols, you and other pointpersons should be able to access different entity-level financial information without having to chase it across emails, spreadsheets, or disconnected systems.

The more fragmented your financial data is, the more reconciliation becomes an exercise in gathering information rather than validating it. And when teams are pulling reports from different sources—or using different versions of the same data—you increase the likelihood of mismatches, duplicated work, and reporting delays during consolidation.

As this is the case, it’s crucial to create a single, consolidated point of reference that relevant staff members can access across the organisation. A general ledger data, a cash transaction history, and a set conversion methodology could all help keep finances standardised across the entire business.

This, in turn, can make decision-making based on more solid foundations. We hope that this guide can serve you well as you streamline multi-entity reconciliation. All the best in managing your team and business’s financial reports!